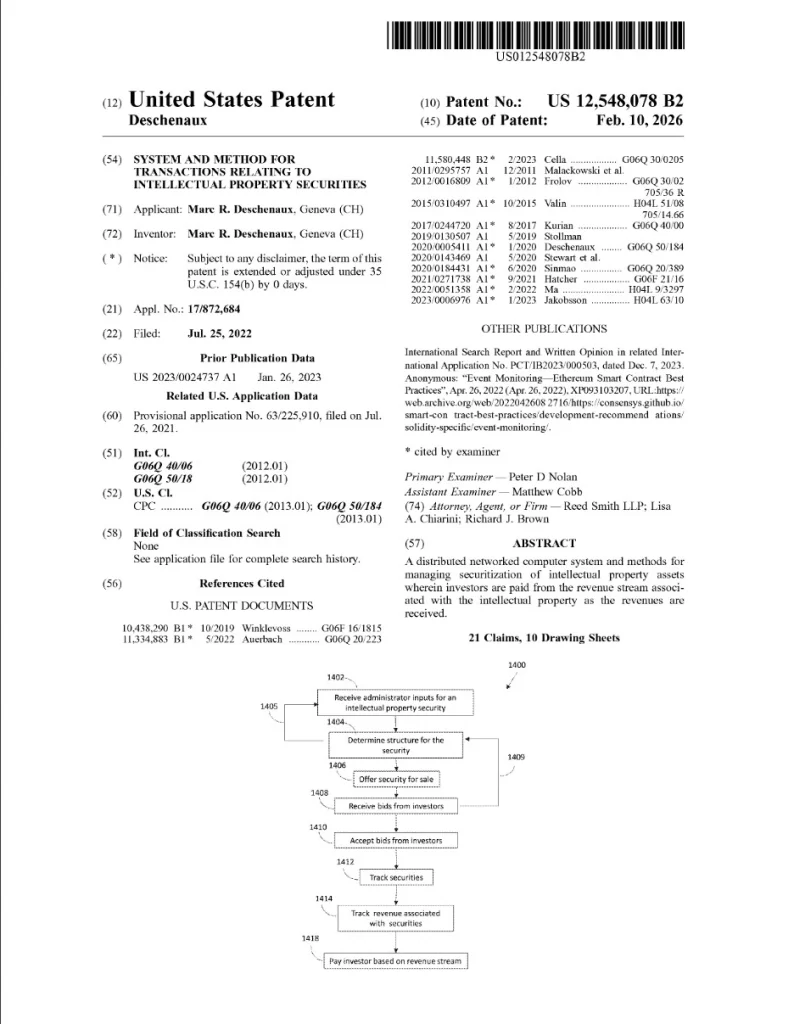

IPSE Secures Major USPTO Patent Protecting Its Complete Business and Revenue Model for Intellectual Property Securities

U.S. Patent No. US 12,548,078 B2 validates and protects IPSE’s end‑to‑end system for securitizing intellectual property and distributing revenue streams to investors

NEW YORK, NY — February 10, 2026 — Intellectual Property Securities Corporation (“IPSE”) today announced a landmark milestone: the United States Patent & Trademark Office (“USPTO”) has granted U.S. Patent No. US 12,548,078 B2, titled “System and Method for Transactions Relating to Intellectual Property Securities.” This newly issued patent protects IPSE’s entire business model and revenue model, covering the core architecture, transaction flow, and monetization mechanics underpinning IPSE’s Intellectual Property Securities platform and operations.

The patent accessible on USPTO search using: 12548078

A defining moment for IP finance—and a decisive validation for IPSE shareholders

With the grant of US 12,548,078 B2, IPSE has secured powerful protection over the foundational system it has developed to finance intellectual property across its full life cycle—including creations and innovations such as patents, copyrighted works, songs, designs, and motion pictures—and to convert those rights and revenue streams into investable, traceable, and serviceable securities.

This milestone is not only a technological achievement. It is a strategic inflection point for IPSE—and a clear confirmation for those who supported the vision early.

Marc Deschenaux, Founder and Inventor, stated:

“Today is a day of recognition and protection for everything IPSE was built to achieve. This patent is the cornerstone of our platform and confirms that the model we designed—turning intellectual property into investable securities while distributing revenues to investors as they are earned—is not only viable, but truly innovative.

And to our shareholders who believed in this project—on my behalf and on behalf of the entire IPSE team—you were right to invest in this project. Your conviction, your patience, and your support helped bring this milestone to life. This patent is for you as much as it is for IPSE.”

What the patent protects

US 12,548,078 B2 covers the essential mechanics of IPSE’s platform—protecting the full transaction and revenue framework that drives IPSE’s business model, including:

Securitizing one or more intellectual property assets into an intellectual property‑backed security (including fractional investment shares).

Allocating investor ownership/shares through structured transaction processes (including bids and allocation logic).

Recording and maintaining transaction integrity through a distributed ledger approach.

Automating and enforcing revenue distribution via smart contract‑based payout mechanisms, with payout events triggered by monetization revenues.

Passing through monetization revenues (e.g., royalties and licensing fees) to investors as revenues are received, aligned with the investor’s allocated interest.

Establishing a scalable framework designed to support private and public market transactions for these intellectual property securities.

In short: the USPTO has recognized and protected IPSE’s complete operating blueprint—covering how IPSE creates the securities, manages them, and earns revenue by operating and servicing the entire ecosystem.

Why this matters: turning intangible value into investable opportunity

Intellectual property is one of the world’s largest value pools—yet it has historically remained complex, illiquid, and difficult to finance efficiently. IPSE was built to change that reality by enabling a system in which investors can invest more directly and selectively in intellectual property rights, while IP holders gain access to financing structures aligned with their assets and revenue potential.

By securitizing IP and structuring revenues as pass‑through distributions to investors, IPSE’s model is designed to:

Expand access to capital for creators and innovators,

Improve transparency and alignment between investment and underlying IP revenue performance,

Increase investor choice through targeted exposure to specific IP assets or portfolios,

Help sustain creative and research‑driven projects through new financing pathways.

A platform milestone—and a shareholder milestone

The grant of US 12,548,078 B2 represents a major strengthening of IPSE’s long‑term competitive position and reinforces the company’s ability to expand its platform, partnerships, product development, and market adoption with strong intellectual property protection behind it.

IPSE extends its deepest appreciation to its shareholders and supporters for their belief in the project. Today’s achievement confirms the strength of that belief—and marks the beginning of a new chapter of execution and growth.

About Intellectual Property Securities Corporation (IPSE)

Intellectual Property Securities Corporation (IPSE) specializes in the securitization of intellectual property, providing a method and toolset designed to finance intellectual property assets—from creative works to inventions—through securities structures linked to underlying monetization revenues. IPSE’s model enables investors to participate in revenue streams associated with intellectual property, while supporting creators, innovators, and rights holders with alternative financing and asset management solutions.

About Intellectual Property Securities Corporation (IPSE)

Intellectual Property Securities Corporation (IPSE), headquartered at 30 Wall Street in New York, NY, is a pioneering company in intellectual property finance. The company provides a marketplace for securitizing and trading intellectual property (IP) assets—such as patents, trademarks, and copyrights—through its innovative Securitizor platform. By unlocking new liquidity for IP owners and creating investment opportunities for investors, IPSE is transforming how IP assets are valued and monetized. The company is committed to establishing a transparent, efficient global marketplace for IP-backed financial instruments.

For more information, please contact:

Intellectual Property Securities Corporation

Media Relations

Skender Djendoubi

eMail: skender@IPSEcorp.com

Phone: +1 (561) 827 1180

www.IPSECorp.com